SALT LAKE CITY — The expansion of the child tax credit, passed as part of the sweeping American Rescue Plan, was estimated to cut childhood poverty nearly in half. But new data from the IRS says the tax agency expects 10% of eligible families to miss out on the benefit.

"Tens of thousands of Utah kids haven't been getting the child tax credit," said Matthew Weinstein, fiscal policy director at Voices for Utah Children.

Just this month, Weinstein said the IRS released data showing that 26,000 Utah children have been missing out on the child tax credit in the past. Based on that data, they expect the same amount to miss out on the expansion, which sends out half of the credit in advanced monthly payments starting July 15.

The reason the IRS expects to miss so may eligible families is because those who would benefit from it most, likely do not file federal or state income taxes.

"You know, they pay other taxes," Weinstein added. "They pay sales tax, gas tax, property tax, things like that, but they don't pay federal income tax."

He said many families who do not file believe they aren't eligible for the credit, but that's not the case.

"As a result, they weren't filing and weren't getting this very important tax credit which is a refundable tax credit," he said. "You receive the credit even if you don't owe anything on your taxes."

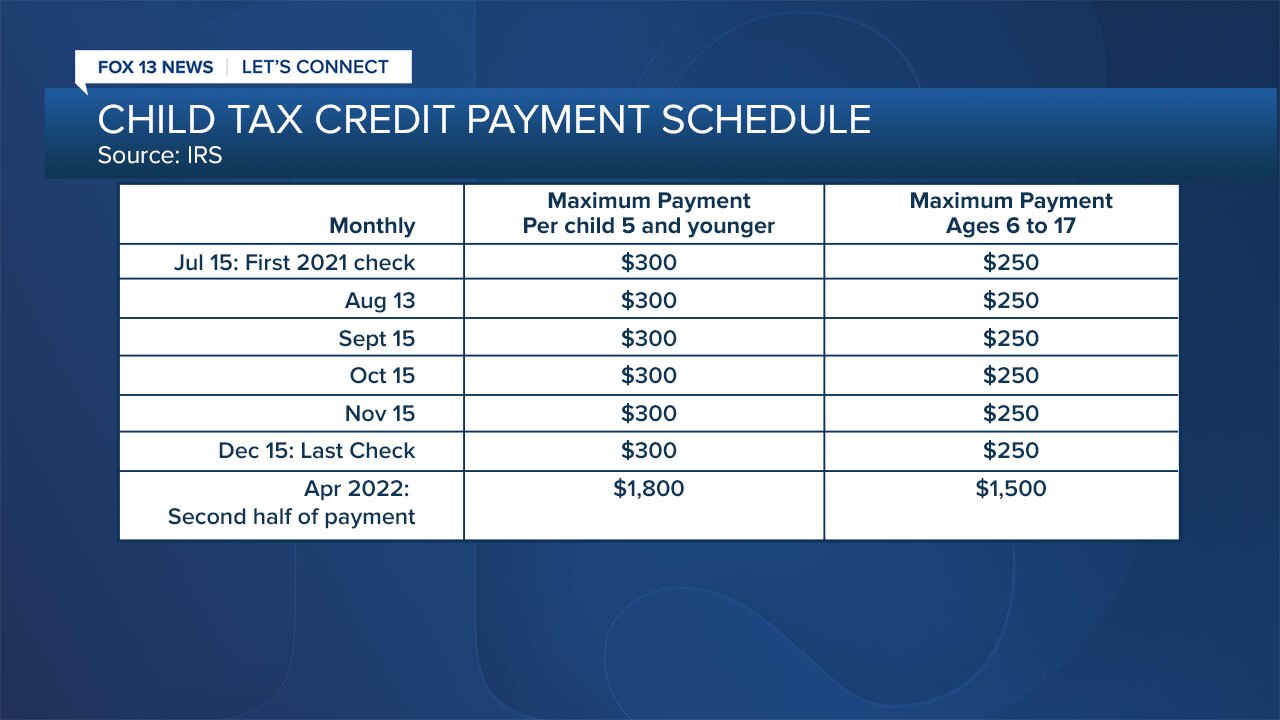

So, who qualifies, and how do payments rollout? Each child under five will get a $3,600 benefit and children six to 17 will get a $3,000 benefit. The credits are split in half with payments of $300 (for children under five), and $250 (for children six to 17) coming monthly between July and January of 2022. The next half comes in a lump sum of $1,800 or $1,500 depending on the age of your child.

"They'll be sending them out by direct deposit, so it's no fuss no muss," Weinstein added. "It's very simple."

Single filers making less than $75,000 per year, heads of household making less than $112,500 per year, and joint filers making less than $150,000 per year all qualify for the full benefit.

"If they miss the July payment, no problem," Weinstein said. "They can sign up for the next one. They'll be going out every month."

The IRS has set up childtaxcredit.gov to help non-filers get enrolled for the credit. They also have resources to check your eligibility if you are curious.

"If you haven't been filing taxes, now is the time to go to that website...and sign up so that you can make sure you get that direct deposit when it first comes out next month," Weinstein said.

If you are adding another child to your family this year, they qualify for the benefit as well. Weinstein encourages Utahns to update their information with the IRS to receive the correct benefit amount.

Tax Help Utah is a non-profit that helps Utahns file state and federal income taxes. Their certified tax volunteers also specialize in helping families register for benefits like the child tax credit, and the best past is their services are free.