It seems there’s an app for everything, and when it comes to managing your money you can do many things right inside your mobile banking app.

James Hilton, VP Product Management at Mountain America Credit Union, joined us with some of the lesser-known features of some of those apps.

He says there are many benefits that come along with using digital products and services. The key is to use them as safely as possible and take advantage of the protective features available to you. Every financial institution and app is different, so you'll need to check with your institution.

At Mountain America, they make it easy for members to set up account alerts to get notified of certain activity quickly. That might mean setting up an alert to be notified any time there is a transaction on your account over $50, or any time your debit or credit card is used to purchase something. That way you can look out for unexpected activity on your account in real time.

Then, if you do get an alert, you can immediately go into your Mountain America app and lock your credit or debit card. That will prevent further charges – by you or anyone else – from going through. You may be able to dispute those transactions online or in the mobile app. You can also order a new card, if necessary.

If you can't do that on your own, James recommends you immediately call the institution about the charges you would like to dispute.

James says on the Mountain America app you can do your typical banking tasks, like depositing a check or transferring money between accounts. You can open secondary savings accounts and certificate accounts, easily, as well.

And if you're looking to monitor your credit score, Mountain America has a tool called Credit Score Plus. The tool shows your credit score and suggests which factors are most affecting your score and what you could do to change it. You can simulate things like what would happen to your score if you got a credit limit increase, or opened a new credit card, or stop making payments on a loan. While this is only one version of your credit score, making similar changes should affect other score versions, as well.

You can also view credit alerts that can help you watch for fraud, errors or other activity that can affect your score. The tool will show all your open accounts, along with the payment amounts and history, and show you a variety of information about all your borrowing.

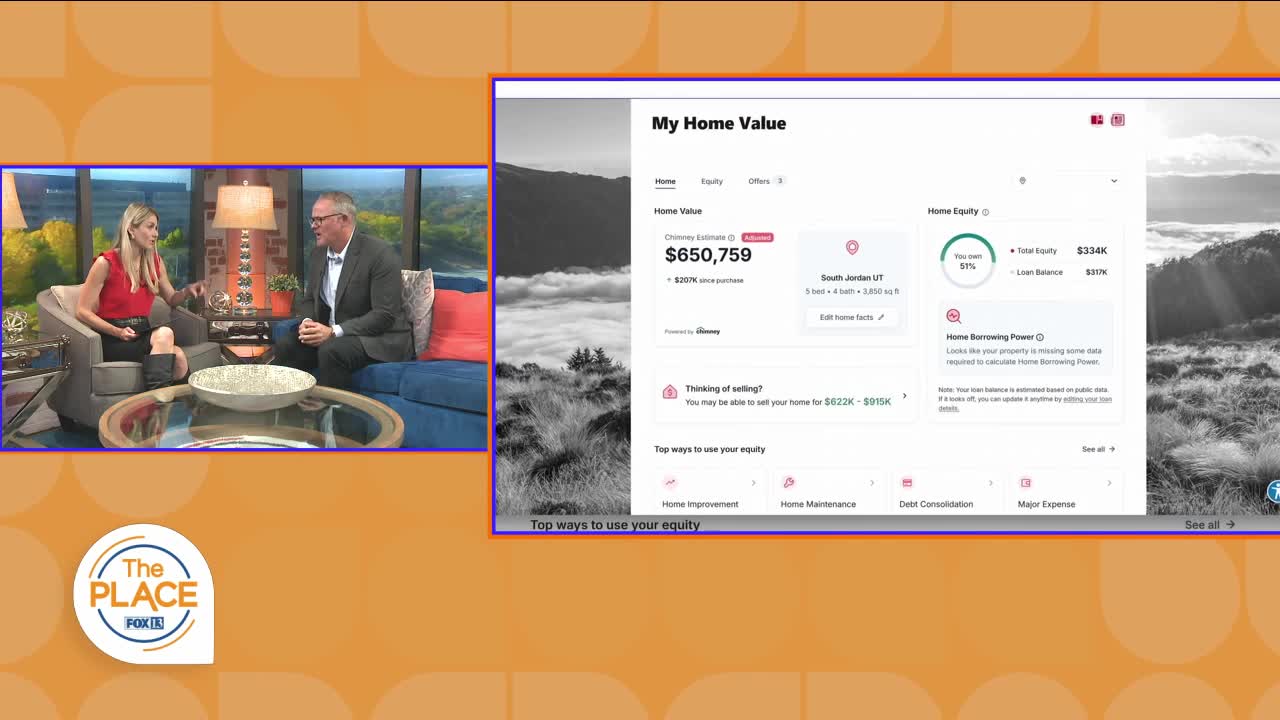

If you're a homeowner, you've probably wondered about the value of your home, especially if you've considered a home equity loan. The My Home Value tool inside Mountain America's app gives you a reliable estimate of your home's value and can even provide some idea of what home equity loan options might be available. That's all free inside the app.

If you'd like to sign up, you do have to be a primary account holder with Mountain America and download the app or log into online banking. Then you can set up your alerts, deposit checks, manage funds and access Credit Score Plus or My Home Value for free.

If you're not already a member, head into a Mountain America branch or go to macu.com/education25. There's even a $150 bonus offer for new members who sign up for MyStyle Checking with the promo code EDUCATION25.

Insured by NCUA

Membership required—based on eligibility.

Equal Housing Lender

NMLS ID 462815

Loans on approved credit.

Limited-time offer. Offer can change or be withdrawn at any time.