Once you've selected your home or auto insurance, it's easy to forget about it unless you need it.

Mason Harrison, Insurance Service Manager for Granite Insurance Services, says you really should review your policies and look for new quotes at least once a year, ideally before your policy renews.

Markets change and pricing can fluctuate, so an annual quote comparison can uncover savings without sacrificing coverage.

If something in your life changes, for example a new teen driver, retiring a vehicle, remodeling your home, or moving, you should revisit coverage even sooner.

If you do have a youth driver, Mason says there are things families can do to make coverage cheaper:

- Keep good grades; many carriers offer good student discounts.

- Add responsible drivers with clean records to the policy to balance risk.

- Shop around — different carriers weight teen drivers differently.

- Consider vehicles that are safer and cheaper to insure, and raise deductibles where affordable.

You can also usually reduce overall costs by bundling home and auto or adding safety devices.

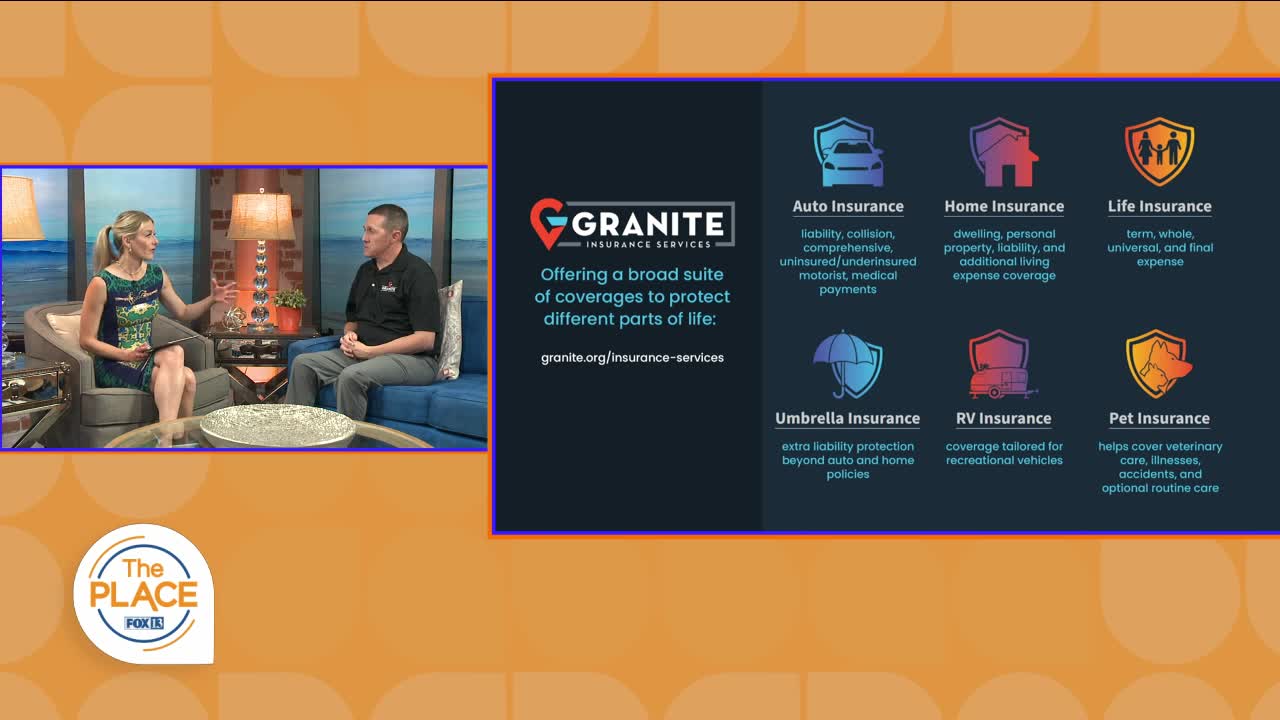

Granite Insurance Services offers a broad suite of coverages to protect different parts of life:

- Auto Insurance — liability, collision, comprehensive, uninsured/underinsured motorist, medical payments.

- Homeowners Insurance — dwelling, personal property, liability, and additional living expense coverage.

- Life Insurance — term, whole, universal, and final expense.

- Umbrella Insurance — extra liability protection beyond auto and home policies.

- RV Insurance — coverage tailored for recreational vehicles.

- Pet Insurance — helps cover veterinary care, illnesses, accidents, and optional routine care.

They will help break things down into everyday language and use real-world examples to illustrate what's included and what isn't.

That's one of the biggest problems people make when buying insurance — they don't understand what's covered.

You also should not choose a plan based on price alone. Mason says lowest cost doesn't always deliver the right protection if something happens.

He suggests to know your policy details and and ask questions before you need it, especially about limits and exclusions.

You can call or text Mason at 801-288-3192 or Email: MasonH@granite.org