Whether you get health coverage through your job or buy it on the marketplace, you’ll likely pay more next year, as health insurance premiums across both public and private plans are spiking heading into 2026. Health policy experts blame inflation, higher prescription drug prices and increased demand for care that drives up costs across the system.

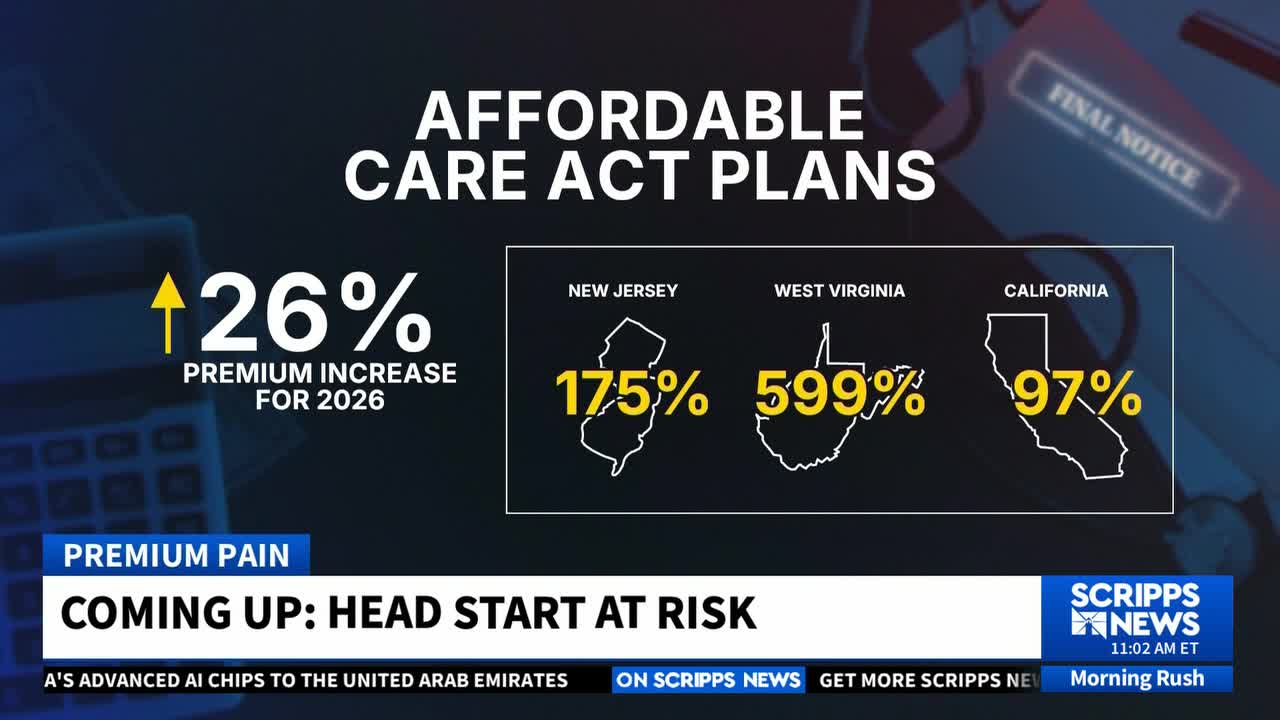

Affordable Care Act plans, which enrolled a record 24 million people this year, are set to rise an average of 26% in 2026, according to policy analysts at KFF. That estimate is one of the largest spikes since the ACA debuted, and doesn’t factor in the expiration of enhanced premium subsidies, so analysts show astronomical increases in some states. For example, New Jerseyans could see a nearly 175% increase, while people in parts of West Virginia could be paying as much as 599% more.

For Anne Griffith in Ohio, who recently retired in order to help care for an aging relative, that will equate to a cost of $1,200 a month.

RELATED STORY | You can now sign up for 2026 Obamacare coverage — but costs may still rise

“My jaw hit the floor,” she told Scripps News. “Paying that each month is going to be very, very difficult.”

A CMS fact sheet lays out that 60% of enrollees will be able to find 2026 plans on the federal exchange with premiums at or below $50 a month, factoring in the original Obamacare subsidies, which are included in the 2010 health reform law and not expiring. However, that differs significantly from the 83% of consumers who could find plans in that price range for 2025 plans.

“What you're seeing right now on Healthcare.gov and state-run marketplaces, you're seeing the price that is your worst-case scenario. This is a very active situation in Congress. Obviously, this is the crux of the issue with the government shutdown,” Louise Norris, a writer with HealthInsurance.org, told Scripps News. “Subsidy enhancements could be extended, or extended with some modification. They could be allowed to expire. If there’s some sort of extension, a lot of folks will see a lower premium than what they're seeing right now. But this is all just very much up in the air.”

RELATED STORY | Obamacare plan costs to soar despite Trump officials’ claims

Meanwhile, employer-sponsored plans, which cover the majority of working Americans, are also expected to surge by nearly 10%, the largest increase in 15 years, according to an Aon survey.

“The cost of healthcare in general in this country just keeps going up. The cost of a physician visit, a hospitalization, prescription drugs,” said Emma Wager, a senior policy analyst at KFF.

Health policy analysts point towards GLP-1s, prescription drugs used to treat diabetes and weight loss, as a major driver of cost. With one in eight adults reporting they’ve taken a GLP-1 agonist, the popularity and expensive price point of the drug drives up costs for employers who include them in their benefits packages.

Wager also explained that the premium increases are outpacing the rate at which wages are growing, combined with inflation driving costs up.

“It's just eating up a higher percentage of the amount of money that they take home,” Wager told Scripps News.

That squeeze is being felt on both sides: employees juggling stagnant wages, and employers struggling to keep benefits affordable.

“Employers want to provide robust coverage, but it’s becoming a barrier for them financially. One of the biggest struggles right now is how do we continue to offer benefits at a certain value point, because it’s one part of a budget that’s been increasing pretty rapidly,” said Noel Cruse, Vice President and Benefits Consultant at Segal.

To account for that, Cruse says employers have looked for ways to “narrow networks,” shrinking the number of providers who are covered under an employer plan. There’s also a focus on increasing telemedicine options, which are less expensive. The intention with these efforts is to ideally keep co-pays and deductibles at the same rates.

A KFF analysis found that some employers are shifting towards high-deductible health plans (HDHPs) and tax-advantaged accounts (HSAs) as another tool to contain costs.

Policy experts say the best defense is doing your homework during open enrollment. That means comparing plans carefully, even if you’ve been enrolled in the same one for years.

“I think it's definitely worth looking at your estimated health expenses and your family's needs to determine which is going to be the best option for you financially,” Wager said.

Experts warn that if costs keep rising, more young and healthy people could drop out of insurance markets altogether, a move that would drive prices up even further, as insurance markets rely on a diverse pool of people paying into the exchanges in order to cover everyone’s needs.