SALT LAKE CITY — As Utah lawmakers consider shifting some of the fuel cost burden from drivers to refineries, a review of the current situation reveals that the legislature bears some responsibility for the comparatively high gas prices in Utah.

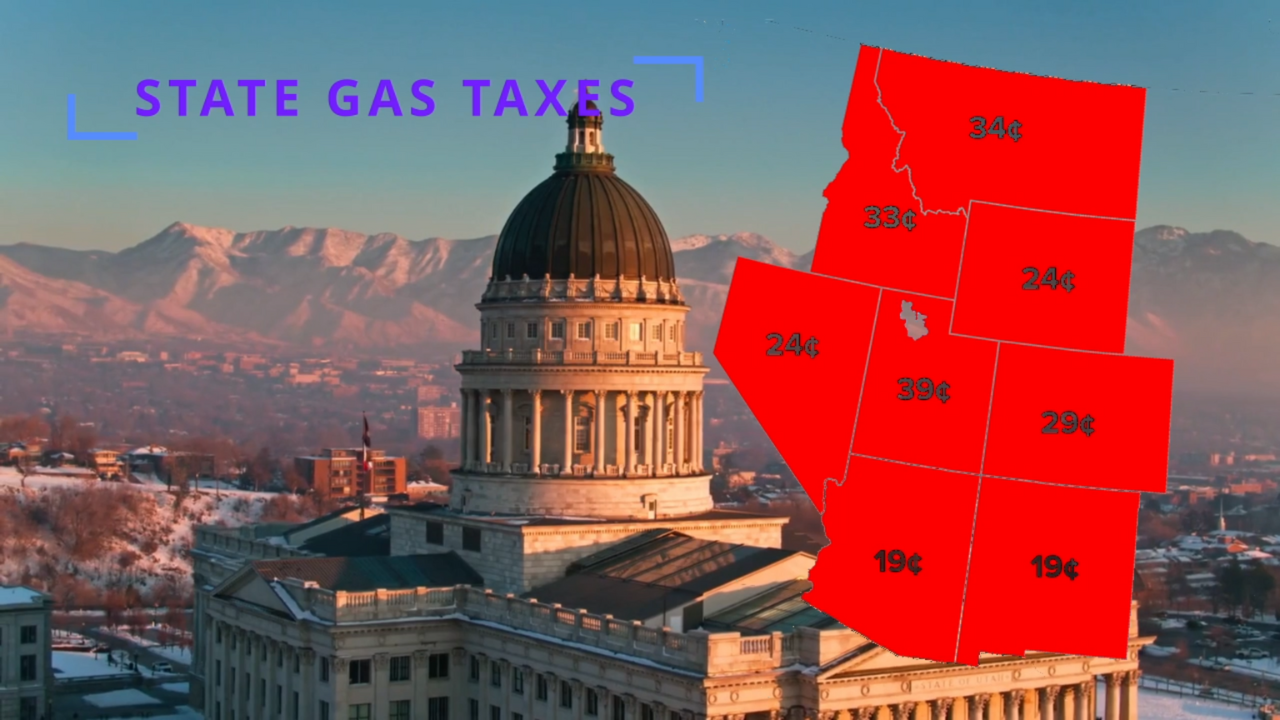

Utah drivers pay 39 cents per gallon in state gas tax, which exceeds every other state in the Mountain West.

That 39 cents amounts to a rate hovering between 10 percent and 15 percent of current fuel prices.

Compare that to the state sales tax at 4.85% and the state income tax at 4.5%.

That high rate is tacked on to already increasing fuel prices creates a burden for drivers like Javier Duarte, who uses his pickup truck for work.

"Every month I spend a lot of money and I gotta figure out how I can pay for gas," Duarte said.

Despite Utah's substantial refining capacity and fuel production, residents often pay more at the pump than their neighbors in surrounding states.

Idaho's legislature runs resolution critical of Utah gas tax bill:

Utah operates five working refineries with a maximum capacity of 209,000 barrels per day, making it the biggest player in the Mountain West region, according to the U.S. Energy Information Administration.

The 39-cent gas tax generated $246 million for the state government in the last fiscal year.

"Yeah, it's pretty high. I didn't even know this, but it makes a lot of sense," Duarte said after learning about the tax rate and considering the price he pays.

"I think we should be worried about Utah for sure. Just bring those down," Duarte said.

My pickup truck has a 36-gallon tank, so when I put 34 gallons in on this visit, I paid more than $13 to the state.